Tokenize Real-World Assets. Launch in days.

White-label infrastructure to issue, sell, and manage digital assets across markets. Build once — operate globally.

Traditional rails are slow and fragmented

Launching an investment platform takes months and heavy engineering.

Payments, minting, and compliance are scattered across tools.

Cross-border expansion is costly and brittle.

CrowdX gives you a ready foundation to issue offerings, accept crypto payments, and manage tokens — with a clean API and a white-label UI.

What you get on day one

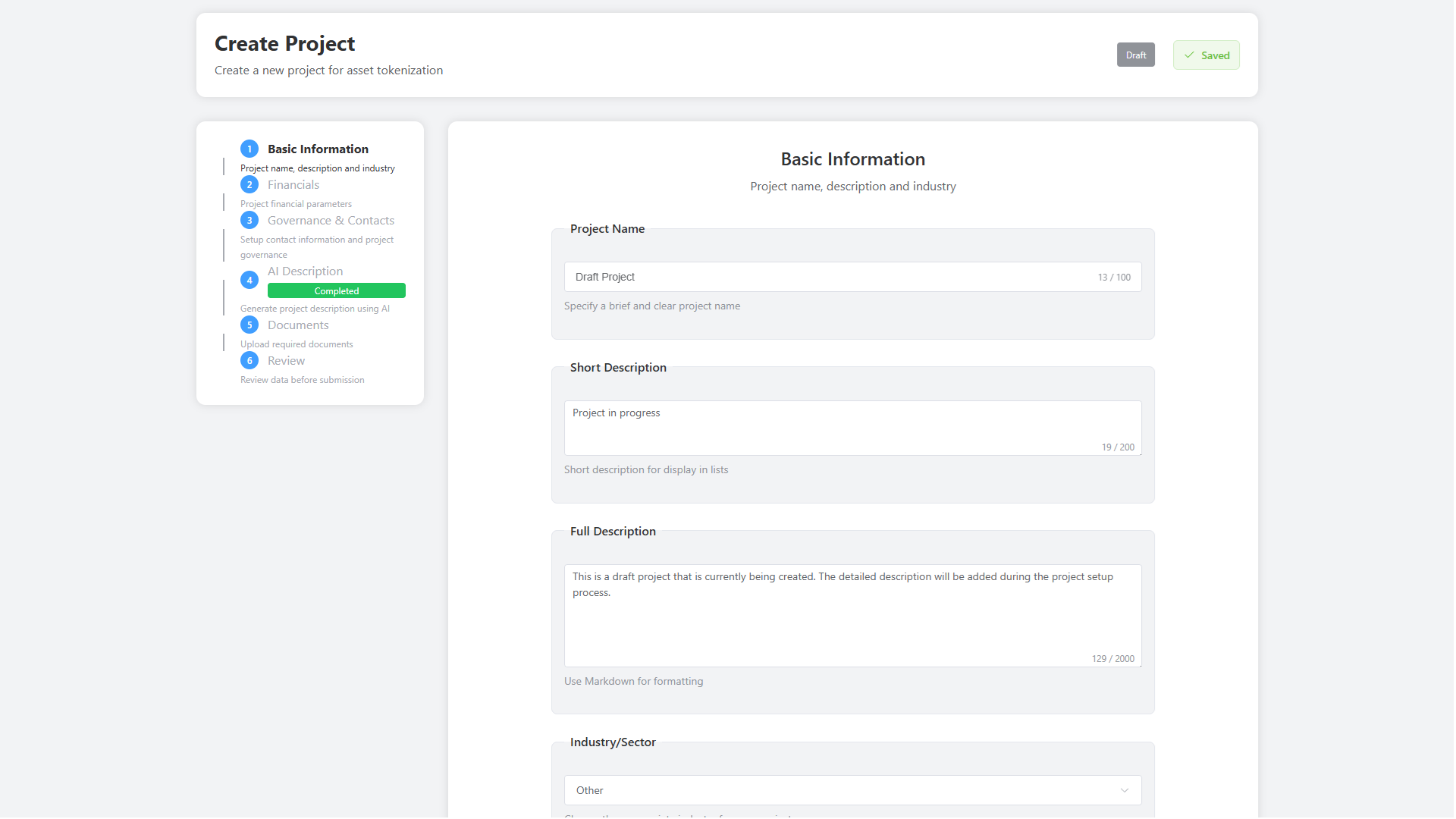

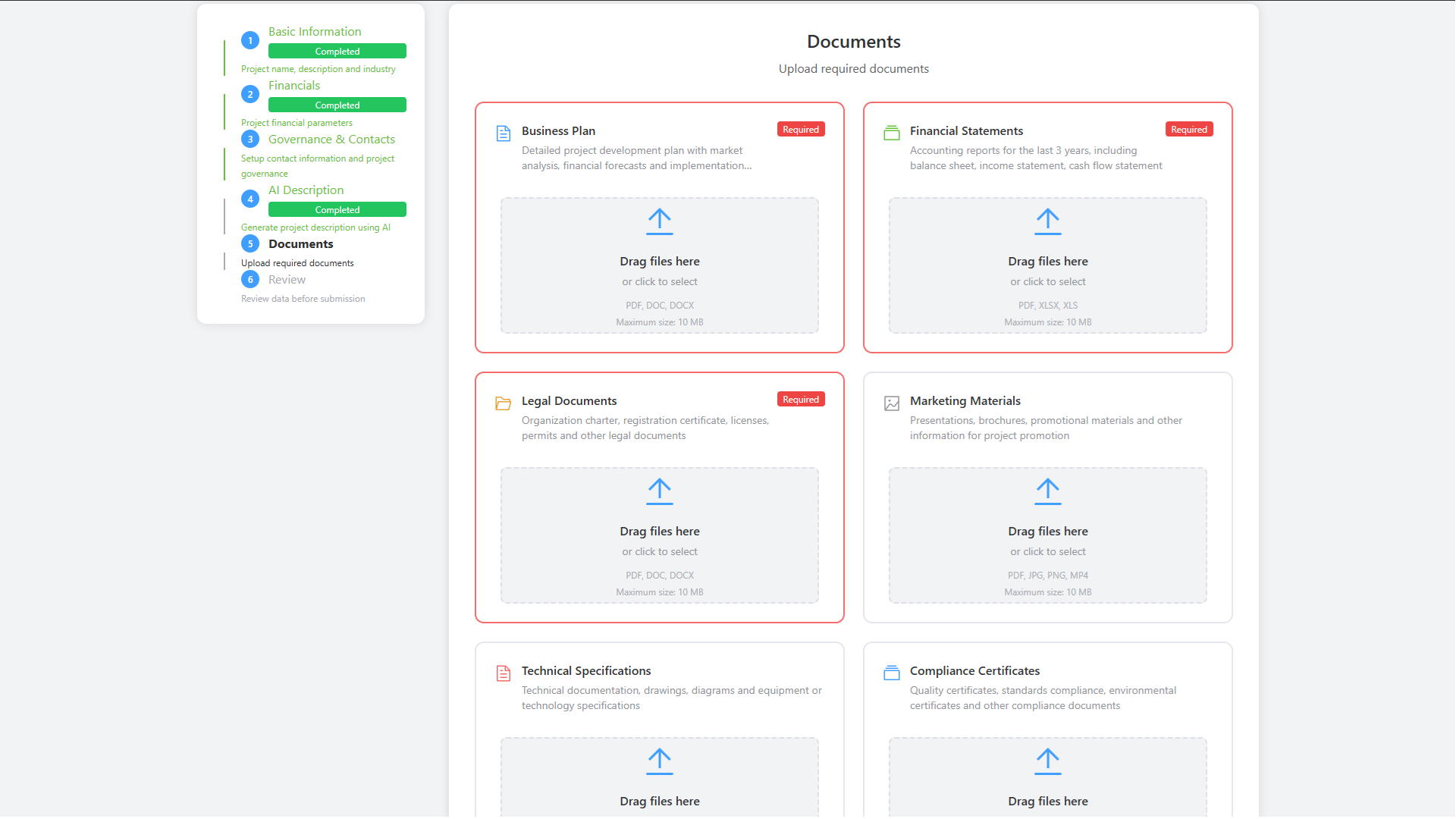

Project & Offering wizards with autosave and validation

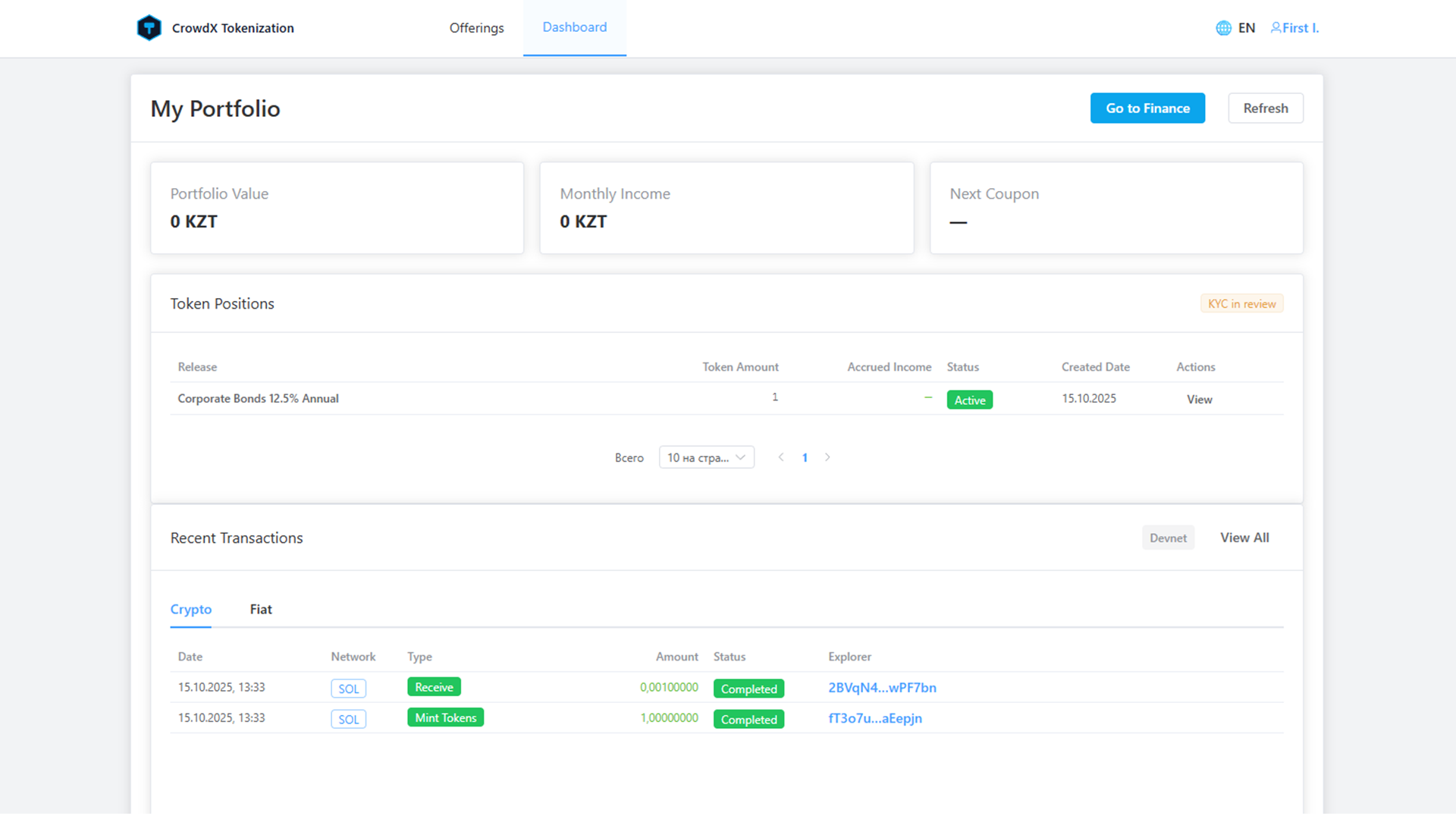

Orders, balances, transactions — investor-grade flows

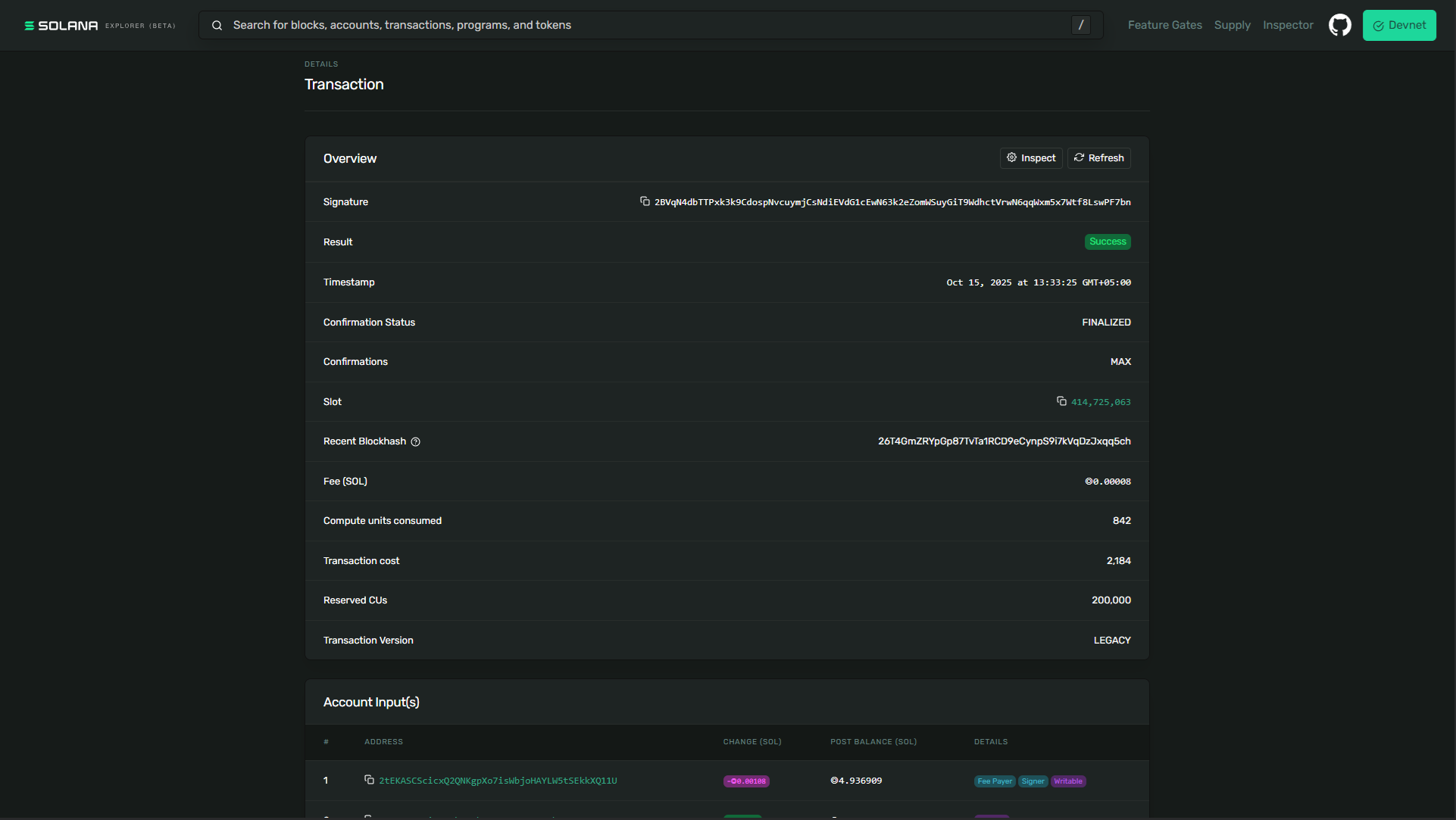

Payments & mint orchestration (Solana Pay, idempotent minting)

Compliance & Audit Dashboard

Secure access: roles, JWT, private documents, audit trails

API & SDK. White-label frontend.

What You Get on Day One

Complete portfolio management, real-time analytics, and transparent transactions — all production-ready.

Technology

Built with modern, scalable technologies for enterprise-grade performance

Frontend: Vue 3 + Pinia (product); Landing: Next.js + Tailwind

Backend: NestJS + Prisma

Blockchain: Solana rails, SPL tokens

E-signature: CAdES-compatible adapter (current: local providers; eIDAS adapters on roadmap)

AI & Automation: Orchestrated assistants for analytics, investor scoring, and content generation

Infra: Kubernetes for app, Vercel for marketing

Architecture Overview

Use Cases

From corporate bonds to real estate — tokenize any asset class with our platform

RWA Portfolios

Bundle multiple asset classes into tokenized portfolios with dynamic yield distribution.

Corporate Bonds

Launch fixed-income offerings with transparent on-chain settlement.

Revenue-Share Real Estate

Tokenize rental income or SPV cashflows.

Green Energy SPVs

Finance solar/wind projects with investor dashboards.

Convertible Loans

Digitize terms and lifecycle management.

Private Equity Syndicates

Invite LPs and manage cap table events.

Platform in Action

Explore different aspects of our platform through interactive screenshots

Investment Catalog

Discover and filter investment opportunities across multiple asset classes

White-label: your brand, our rails

Launch your branded tokenization platform in weeks, not months

Custom domain, logo, and investor portal

Payments + mint orchestration ready

API/SDK to integrate your CRM and back-office

Go-live in weeks, not months

Legal adapters: design-ready; implementation scheduled per market.

Roadmap

Clear path to global expansion with regulatory compliance

Q4 2025

Currently validating investor and issuer flows under Kazakhstan framework (Solana Devnet)

Q1 2026

EU legal adapters (Spain first)

Q2 2026

First EU pilot (production rails)

Q3 2026

Marketplace beta (multi-asset listings)

Q4 2026

White-label 1.0 (billing, self-serve)

2027

LATAM adapters + secondary trading integrations (subject to regulation)

2027

AI-powered investor intelligence & compliance automation

Currently validating investor and issuer flows under Kazakhstan framework (Solana Devnet)

Why invest in CrowdX

Large, under-served market for compliant digital assets

Hybrid revenue: SaaS + tokenization fees

Working demo and production-grade backend

Clear global expansion plan

Get detailed financial projections and market analysis

Let's talk

Partnerships, pilots, or investment — send a note.

Get in Touch

Partnership Types

Send us a message

Or email us directly: hello@crowdx.pro